Podcasts are losing their advertising momentum and are turning to video to turbocharge their audiences.

Podcast producers plan to expand their tentacles into the video world to try to gain traction in the coming months and ultimately win the trust of more advertisers.

Although the influence of podcasts on the cultural and political scene continues to grow (and is already enormous), the truth is that the advertising investment this format attracts is slowing. For this reason, podcast producers plan to extend their tentacles to the video world to try to gain traction in the coming months and ultimately attract more advertisers.

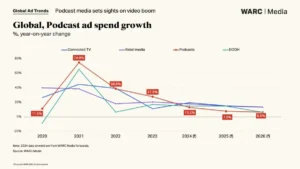

According to a recent report by WARC Media, global podcast advertising spend is projected to reach $4.8 billion in 2024, surpass $5 billion in 2025, and potentially reach $5.5 billion in 2026. However, year-over-year growth in podcast ad spend is expected to slow down soon, falling from 13.2% in 2024 to 7.9% in 2025 and 6.5% in 2026.

The growth rate of advertising spending on podcasts will, in this sense, be substantially lower than that of other emerging channels such as retail media (+14.8% in 2025), CTV (+15.4%), and digital outdoor advertising (+14.9%).

The slowdown in advertising investment in podcasts is likely to be influenced by the difficulties advertisers face in scaling their advertising efforts on this channel and the lack of measurement tools this channel offers.

Podcast audiences are growing, but advertising investment is not increasing at the same pace.

However, WARC’s annual Marketer’s Toolkit study concludes that more than half of advertisers globally (55%) plan to boost their advertising investment in podcasts by 2025. And this channel ranks fifth in terms of advertisers’ spending intentions, behind only online video, influencer marketing, and social media.

Although podcasts’ advertising appeal is weakening, their audience continues to grow rapidly. Their global audience reach has climbed from 60.6% in 2020 to 66% in 2025.

In the United States, for example, 135 million people consume podcasts monthly, a figure equivalent to 47% of all consumers over the age of 12.

Younger people, on the other hand, spend more time daily on podcasts than other age groups. And in the second quarter of 2024, this channel’s reach among young people belonging to Generation Z (68%) exceeded that of radio by 10 percentage points.

In markets such as the United Arab Emirates and Brazil, podcast listening among all adult users has already surpassed radio, while in countries such as Germany and China, this channel, on the other hand, does not show as much strength.

Video, the podcast «subscription» to continue sprouting green shoots

YouTube has recently emerged as the most popular platform for podcasts that take refuge in video. And in 2024, more than 400 million hours of podcasts were listened to per month on the YouTube TV app. Along the same lines, more than 250 million users have already consumed video podcasts on Spotify (a habit that is particularly prevalent among millennials). During the first five months of 2024, Generation Z watched 2.9 billion minutes of video podcasts, 58% more than during the same period the previous year.

The upward trend in video podcasts may help this model escape the so-called audio bubble and also attract the attention of more advertisers. However, the shift from podcasts to video is not without its obstacles, as many consumers minimize the video tab and listen only to the audio. This is leading some creators to refuse to embrace video and eventually lose control over the monetization of their content.

The United States, the promised land of podcasts

The United States, on the other hand, has the reputation of being the market that swallows the most advertising investment worldwide in the podcast market. The North American country accounts for almost half (45.9%) of global advertising investment in this channel.

However, even though podcasts capture 4.5% of all ad-supported media consumption overseas, this channel only receives 1% of total advertising investment in the United States ($4.2 billion in 2025).

In the United States, brands such as Amazon, T-Mobile, Capital One, and Toyota are making their way onto the list of advertisers that invest the most in podcast advertising.

Furthermore, podcasts are becoming increasingly important in political discourse in the United States, as was clearly evident in the last presidential election campaign across the pond. Donald Trump, the current White House resident, appeared on podcasts during that campaign with an average reach of 23.5 million listeners, far from the 6.4 million listeners reached by the podcasts featuring his opponent Kamala Harris. Furthermore, the podcasts featuring Trump generated two to three times better results for brands in areas such as website visits, subscriptions, and purchases.

It’s also worth noting that 44% of users say they got their information about the US elections from podcasts, ahead of cable television (34%) and platforms like X (33%).

Podcast Listeners’ Receptivity to Advertising Increases

Furthermore, based on the results of research conducted by Acast, 40% of podcast viewers say that podcast advertising has become more relevant in recent years. However, while programmatic buying is increasingly making its way into podcasts (and supposedly undermining the relevance of advertising), other studies show that 42% of regular podcast listeners deliberately skip ads, effectively calling them intrusive.

It also appears that episodic ads (appearing in a single episode of a podcast) generally perform better than those that air in every episode. Another fact that advertisers should also take into consideration is that, as the length of ads aired in podcasts increases, traffic to advertisers’ websites typically increases.

Source: www.marketingdirecto.com